During the Michigan, reasonable no-down-payment mortgages is actually appealing to basic-go out buyers and you may recite people the same. One of the most prominent reduced-dowpayment mortgage programs available ‘s the FHA loan through the Federal Housing Management. Almost one in 5 You.S. home buyers use a beneficial FHA mortgage to invest in a different household purchase.

FHA mortgages are aggressive mortgage software. FHA mortgages allow homebuyer to put off as low as a good step three.5% down payment And have now poor credit. Due to the fact Government Construction Authority ensures the financial, Guild Home loan Inlanta are significantly more willing to leave you financing terminology making it easier for you so you can qualify.

In addition to less strict underwriting requirements, FHA financial cost shall be below equivalent conventional pricing, and you will FHA money should be presumed from the good house’s next buyer. Brand new FHA loan’s mix of reasonable costs, low down payment, and versatile credit guidance have actually made it among common financing options for home buyers today.

- lower settlement costs

- downpayment should be gifted on the homebuyer such as. off family members, employer etc.

- on step one-4 equipment functions

- dollars supplies not necessary

- closing costs are going to be paid back because of the provider

- versatile being qualified obligations so you’re able to earnings percentages

- streamline refinance offered

Exactly how is an FHA Home loan Organized Than the Almost every other Mortgage loans?

FHA Mortgages need home financing advanced are gathered from the closing (upfront MI) and you can an annual advanced is accumulated when you look at the monthly premiums. Brand new FHA financial cost isn’t the same as your own homeowner’s insurance policies and that’s called for of all the individuals. A typical month-to-month mortgage repayment into the an excellent FHA mortgage boasts dominant and you can focus, taxes, monthly insurance premium (MIP), homeowners insurance.

FHA Mortgage Insurance premiums A 2-Sided Coin

You may be thinking unusual to call FHA mortgage insurance good results as it does not already been free-of-charge, not, FHA MIP is the reason why the brand new FHA system you’ll. Without the MIP, FHA-approved loan providers could have absolutely nothing reasoning and then make FHA-covered finance. And because of your MIP, the genuine financial price tends to be all the way down while the FHA is actually insuring your loan facing default. MIP is where the latest FHA accumulates dues to store its system open to U.S people free of charge so you can taxpayers. On the other hand of the money, the fresh MIP adds rates to your loan.

Thus despite, otherwise on account of MIP, FHA funds can be more pricey, or economical, than many other loan sizes. The a lot of time-label cost of an enthusiastic FHA financing depends on the loan dimensions, your own downpayment, and your venue.

MIP was paid in two fold. The original part was reduced at the closure which will be labeled as Initial MIP. Initial MIP is immediately placed into the loan equilibrium from the FHA therefore zero commission required at the settlement. Initial MIP is equivalent to step 1.75% of your own financing dimensions.

Thank goodness you to definitely, because the a homeowner or home client, your own FHA MIP rates enjoys decrease. Today’s FHA MIP costs are today around 50 basis situations (0.50%) down per year than they were nowadays.

Along with, you have got a means to clean out just what you’ll owe during the FHA MIP annually in addition to having fun with an effective fifteen-12 months mortgage label for your mortgage; or, and come up with a down-payment with a minimum of 5 percent.

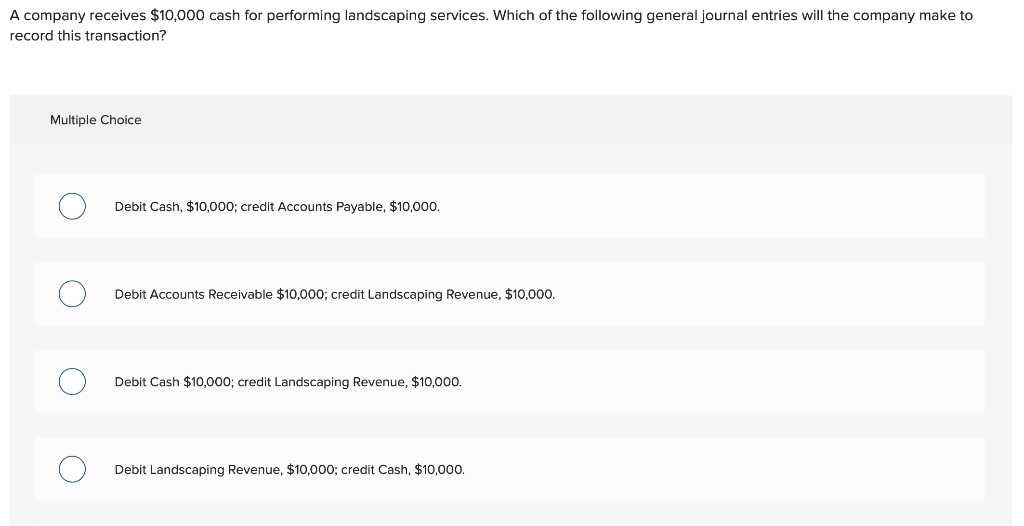

Tips Qualify for FHA Financing

So you’re able to qualify for FHA mortgage, a home loan borrower must meet with the minimal conditions of one’s Government Homes Administration’s americash loans Ashville home loan program, including proving a minimum credit history off five hundred, even if buyers want no less than 620. Individuals need proven earnings and you can employment, as well as confirm the updates given that a legal resident regarding the us. The program is available so you can earliest-big date homebuyers, repeat homebuyers, and will be used to re-finance a preexisting mortgage of every kind of. The FHA loan will not enforce an optimum money restriction.

Figuring FHA Home loan Insurance costs:

step 1. Beforehand Home loan Advanced (UFMIP) funded on the overall loan amount at the very first lifetime of financial support

Old-fashioned financing which can be higher than 80% Loan-to-Really worth also require mortgage insurance coverage, but within a relatively higher level than just FHA Home loan Insurance costs.

Home loan Insurance policy is an invaluable part of most of the FHA mortgage as the financing one just requires an excellent step 3.5% deposit is generally viewed because of the loan providers just like the a dangerous proposition.