Did you know that of a lot finance not one of them an assessment to reduce your interest on your own mortgage? One of the greatest difficulties for all of us considering a speed protection refinance ‘s the upwards-top price of an assessment.

Mortgage Prices try Finally Dropping!

Research strongly recommend cost have a tendency to lightly slope down through the end regarding the year. Earlier this times, cost plunged as they are now constant slightly below six.5 %, which includes maybe not been enough to promote potential real estate buyers.

Several times, if you get a home loan, an appraisal is required to report to the lending company the issue of the property and the market value. For legal reasons, appraisals is done from the independent 3rd party registered appraisers.

They generally charges the buyer up front because of their characteristics. The price of an appraisal may differ according to the possessions place and assets form of. The typical price of an appraisal is ranging from $five-hundred and you can $650.

Should i Re-finance a conventional Mortgage as opposed to an appraisal?

Refinancing a normal financing you are able to do as opposed to an assessment. While not all the will qualify, Fannie mae and Freddie Mac computer each other promote property review waivers and this meet the criteria on the both Purchase Money and you will Re-finance Financing.

Locate a house review wavier to your a normal mortgage, you will need to provides at least 20% Collateral (80% Financing to help you Value). The reason being Private Mortgage Insurance firms always require an assessment to accept new PMI.

NOTE: Not all the finance companies and you will loan providers can offer Federal national mortgage association and you will Freddie Mac recognized mortgage loans. As a result if perhaps you were said aren’t eligible from the a different financial, Riverbank might still manage to advice about zero appraisal needed!

Exactly what limits are there to complete a normal Loan rather than an Assessment?

- No cash-Out Refinances

- Zero Money Services

- Solitary Members of the family Residences Merely site (Zero Multiple-Equipment Property)

- Loan should be under the Conforming Financing Constraints

- Zero Properties in which Desperate situations can be found predicated on Vendors Disclosure otherwise Checks

- No Are produced Residential property

- No Constructions Financing

- No Low-Hands Size Deals

How to found an appraisal Waiver?

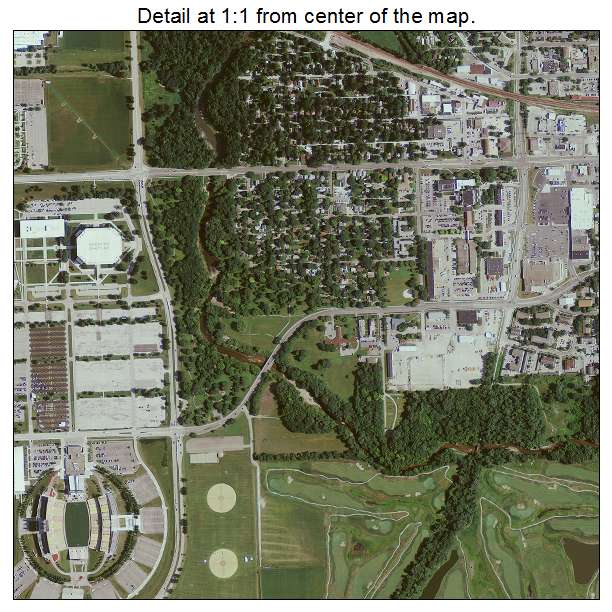

Riverbank Loans LLC might help manage work at automated underwriting to see when you’re granted an appraisal waiver. It is likely to be you will have the appraisal waived for those who have got an appraisal in the last few ages. Almost every other helpful facts are recent equivalent conversion process in the region and city otherwise suburb towns and cities.

We just you need your property target and estimated property value and all of our app often prove when you’re entitled to an appraisal wavier!

Virtual assistant IRRRL to help you refinance good Va Loan no assessment

Military pros you to actually have an excellent Va loan on the no. 1 quarters tends to be eligible to drop their attention speed which have an excellent Virtual assistant IRRRL (Interest Avoidance Loan).

Criteria include at the very least 210 weeks passing because your very first percentage and you can good re-finance advantageous asset of at the very least .5% of your current interest rate. You’ll want no later money in the last 12 months. Enough time to recuperate your own can cost you of refinancing will have to feel lower than 3 years to confirm work with.

It streamlined refinance loan expected restricted papers so that pros in order to benefit from down costs and you may costs. No Money without Appraisal and simply a mortgage credit score required.

Re-finance an enthusiastic FHA mortgage without Appraisal with an enthusiastic FHA Improve Re-finance

Just as the Virtual assistant IRRRL, home owners one to actually have an FHA mortgage could probably straight down their interest price without assessment which have an FHA Improve Refinance mortgage.

You’ll want zero late payments within the last 1 year and you will 210 days have to have elapsed since your paid off very first fee on the most recent Virtual assistant financing. You need to lose your rates as well as PMI about .5% to verify an advantage. Your loan matter is restricted on FHA streamline refinance loan computation.

That it financing lets a citizen when planning on taking advantageous asset of lower financial pricing with restricted paperwork. They can to close quickly with no appraisal, zero money papers and simply home financing credit score.

Exactly what are the Benefits of Refinancing my Financial?

Refinancing you home loan can be a beneficial financial decision. They never ever affects to review your options to see if a great mortgage refinance is good to suit your needs.

- Lowering your Interest rate Losing their rates can get save you thousands during the Focus.

Chat to an effective Re-finance Pro

Riverbank Loan Officials is actually advantages on home mortgage refinance loan alternatives. We possibly may have the ability to save plenty when you look at the focus opposed with the most recent home loan.