Q: I’m seeking boost my credit rating in advance of trying to get a huge mortgage, thus I am offered joining Borrowing from the bank Karma to trace my score. How accurate could be the credit scores it offers? Could there be some thing I need to look for prior to signing up for this solution?

A: Borrowing from the bank Karma try a legitimate providers; not, for assorted factors, their score can differ considerably regarding number your own lender commonly reveal to you if it checks your borrowing.

What’s Credit Karma?

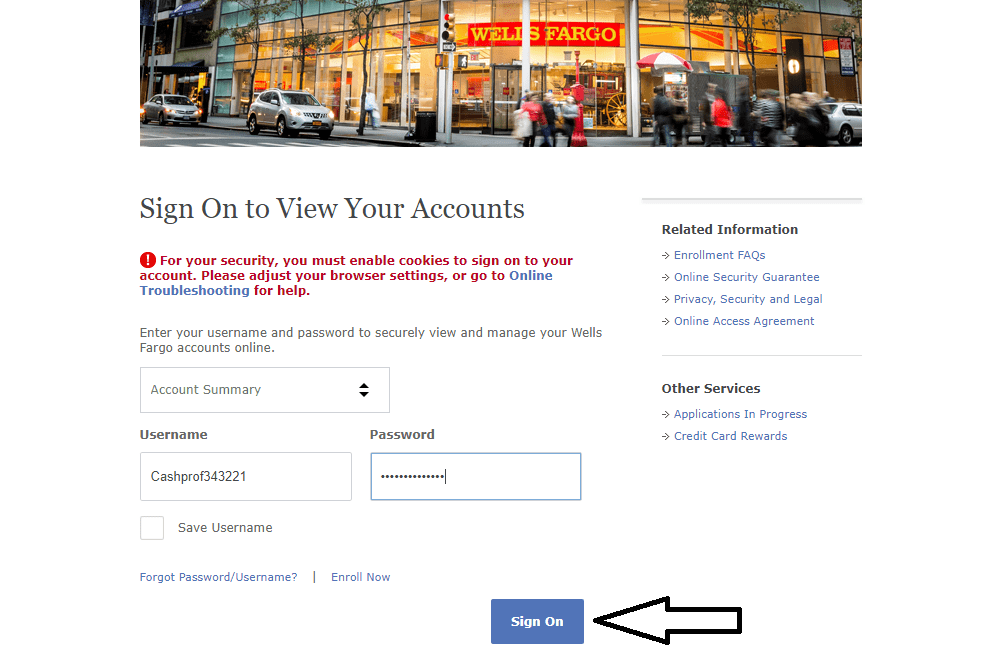

Credit Karma is an on-line credit solution you to definitely works according to the idea that everybody is eligible to a totally free and you may truthful borrowing from the bank score. To this prevent, this site makes you check your credit incase you want without having to pay one fees-a privilege that can ask you for regarding the $20 1 month from the competition. You’ll want to create the service and you will share particular delicate pointers, just like your Societal Security count and your economic wants, you are not asked for one credit card quantity or username and passwords.

Results is updated regular, therefore the providers merely functions a smooth query http://www.paydayloansconnecticut.com/cornwall-bridge/ on your borrowing from the bank to find the necessary data.This means the get is never affected by it checking the borrowing for you. Borrowing from the bank Karma offers plenty of borrowing guidance, personalized financing calculators and you will recommendations into the lending products of all classes.

Borrowing Karma brings in the finances courtesy focused advertisements. As you see your path within webpages and start so you can constant it more often, you will notice adverts which might be aimed toward your specific finances. Particularly, in case your borrowing from the bank is superb and you are clearly in search of property loan, you’ll likely find a lot of ads off home loan organizations. Although this appears like a breach of privacy, it’s no different than just how larger on line networks you almost certainly use, in addition to Google and you can Fb, secure a profit.

The web borrowing providers uses pointers out-of a couple of around three biggest credit bureaus, TransUnion and Equifax, in order to a beneficial VantageScore 3.0. Although this form of credit history is becoming more popular one of lenders, you may not admit they-and also for valid reason. The fresh FICO scoring design is certainly probably the most popular credit score certainly one of loan providers and you may loan providers across the country, with ninety% away from loan providers using this type of rating so you’re able to websites potential individuals.

The fresh atypical scoring model employed by Borrowing Karma, coupled with the absence of information out-of Experian, the third of around three significant credit reporting agencies, produces Borrowing Karma results range from score drawn by other companies and you will financial institutions. The financing provider often is contained in this diversity and a beneficial indication of one’s full borrowing from the bank fitness. You can also find research which have a thinner credit rating from this design, which is very-great for those people seeking build their credit from the ground upwards.

Just how do other loan providers calculate my personal get?

Very financial institutions explore an effective FICO scoring design to measure consumers’ fico scores. As mentioned, this amount would be less than the fresh new get the thing is that to the Borrowing Karma, however, commonly fall in exact same general diversity.

It’s also important to observe that, each time you make an application for a particular particular mortgage having a personalized bank, it can probably additionally use its own customized formula. Such as for example, if perhaps you were applying for a home loan that have home financing company, it could probably fool around with a rating which is specifically put up to own mortgage loans. Also, if you decided to sign up for a car loan regarding an enthusiastic automobile bank, it will use its very own score designed to assume the chance of you defaulting toward an auto loan. This will result in an amount straight down credit history because of these lenders.

Will there be any kind of way to get my credit score?

If you’re looking having a relevant credit score, you really have several options. You could query a possible financial to get your borrowing, no matter if this may ask you for both in costs along with a beneficial hit towards the credit into the hard query. You might to buy your free credit history with advice from all about three credit bureaus one per year, during the AnnualCreditReport. Lastly, to get more constant overseeing, you could sign up for use of their FICO rating and 3-agency credit history for the Experian, in which packages start on $ a month. There are other comparable services nowadays, but most aren’t legitimate otherwise was grossly overpriced.

How come Section 705 determine whether I’m qualified to receive a loan?

I utilize the FICO model so you’re able to estimate your credit score whenever your get a huge mortgage. Although this amount will most likely change from the Borrowing Karma rating, it provides us a larger picture of your own credit because it includes advice pulled off every about three credit agencies. We will along with review the full financial history and you will trajectory to decide if you find yourself eligible for the loan.

Here at Part 705, our very own purpose is to help you go and continue maintaining financial fitness. For that reason, our company is significantly more planning to accept financing for starters of our participants than a haphazard financial exactly who cannot be aware of the the first thing about you or debt history.

When you’re trying to increase your credit score before you apply having an enormous financing, we could help! Remain in Point 705 today to communicate with a financial counselor about things you can do to switch the borrowing from the bank.

When you are willing to take out financing, make Point 705 the first end! Our stress-100 % free software process, low interest rates and you will realistic terms generate us the top for your upcoming high mortgage. We’ll let change your dream home otherwise auto on possible.