Immediately after a loan provider enjoys gained information about a borrower’s money and you may expenses, a decision can be produced payday loans Tuskegee as to how much the fresh new debtor have enough money property. Because the other mortgage programs may cause various other valuations a borrower is to get pre-qualified for each mortgage particular the borrower may qualify for.

From inside the trying to agree homebuyers for the particular and number of home loan needed, mortgage organizations evaluate two important aspects.

Power to pay-off the borrowed funds is verified by your most recent employment and you can total earnings. Generally speaking, financial people like for you to was in fact employed during the exact same spot for at the very least couple of years, or at least get in a comparable line of work with many years.

The loan Estimate also will provide you with information about the projected can cost you out of taxes and insurance coverage, and exactly how the speed and you will repayments can get improvement in this new upcoming

The latest borrower’s desire to repay is dependent upon exploring how possessions was utilized. For-instance, could you be life style around or simply just leasing it? Readiness is even closely related to the way you possess came across previous monetary obligations, for this reason the fresh new emphasis on the credit Statement and you may/otherwise the rental percentage background.

It’s important to just remember that , there aren’t any statutes created in the brick. For every candidate try handled to your an incident-by-case base. Therefore even though you show up a small quick in one single town, the stronger part can make right up toward weak one. Home loan companies couldn’t stay in providers once they don’t create financing team, therefore it is in the everyone’s welfare to see that you be considered.

To correctly become familiar with a mortgage program, the borrower needs to remember how long he intends to contain the mortgage. If you plan to market the house in a number of many years, a variable or balloon mortgage may make a lot more experience. If you are planning to save our house for a longer time, a fixed loan can be considerably better.

Pre-certification begins the borrowed funds techniques

With so many software to pick from, each with various costs, products and you can costs, shopping for a loan can be cumbersome and you can difficult. A skilled home loan elite is consider a beneficial borrower’s problem and you will strongly recommend the most suitable financial system, ergo enabling new debtor making the best choice.

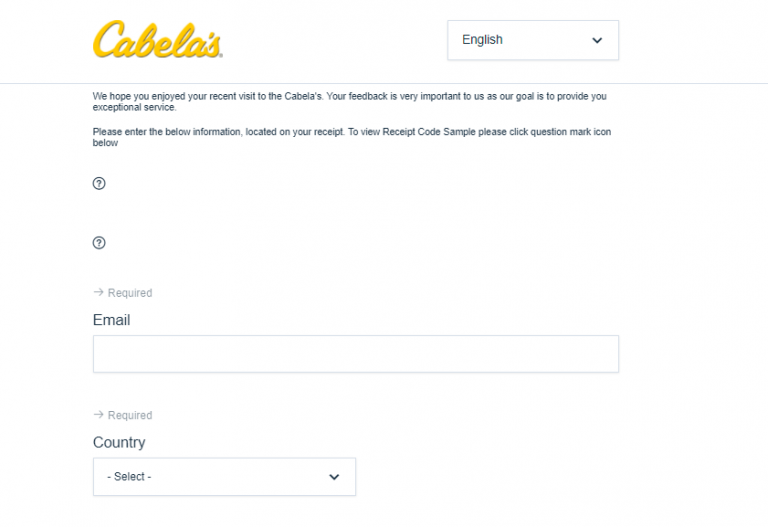

The program is the next step of your financing processes. By using a mortgage elite, new debtor completes the program and will be offering every Requested Paperwork.

A credit card applicatoin isnt thought complete if you don’t features offered all of us at the least the following information: (1) Their identity, (2) Your revenue, (3) Their Social Defense count (and you will agreement to check on your own borrowing), (4) The fresh new target of the house you want buying otherwise refinance, (5) An offer of your house’s really worth and you may (6) The loan amount you want to acquire.

Financing Guess try an excellent three-page function that you will get immediately following applying for a home loan. The borrowed funds Estimate lets you know crucial facts about the loan your has expected. We’re going to deliver which to you with in 3 days of your own fully completed application for the loan. The loan Guess will provide you with important info, like the estimated interest, payment, and you will overall closing costs toward financing. Simultaneously, the borrowed funds Guess also suggest in the event your mortgage have unique features that you will want to be familiar with, particularly penalties to have paying off the borrowed funds early (a good prepayment punishment) or grows on the home mortgage equilibrium regardless of if payments is made punctually (negative amortization). The proper execution uses obvious language in fact it is made to help you most readily useful comprehend the regards to the loan mortgage you applied for. Most of the loan providers have to utilize the same practical Loan Guess function. This makes it simpler for you to compare mortgages so to find the one that is good for you. After you discovered a loan Guess it will not imply that your loan has been acknowledged or rejected. The mortgage Guess demonstrates to you what loan terminology we can provide you if you progress.