A taxation guarantee finance purchase ‘s the useful exact carbon copy of good financing if the:

( a great ) Taxation collateral fund transactions. S.C. 24(Seventh) and 1464 as long as the transaction ‘s the useful same in principle as a loan, because the considering inside the part (c) in the section, and deal suits applicable requirements within the paragraph (d) regarding the area. The right to practice tax security funds deals less than so it point try pursuant in order to a dozen U.S.C. 24(Seventh) and 1464 lending expert that’s separate of, and won’t limit, most other investment regulators offered to federal banking institutions and you will Federal coupons relationships.

( step 1 ) Appropriate OCC supervisory office setting the OCC office that’s responsible on the oversight away from a national lender or Federal coupons connection, since discussed from inside the subpart An excellent of a dozen CFR region 4;

( step three ) Taxation equity money deal form a deal in which a nationwide lender or Government discounts organization brings security funding to pay for an excellent opportunity otherwise tactics you to definitely make tax credit and other income tax pros while the the means to access a guarantee-founded framework lets this new import of them loans or any other income tax positive points to new national financial otherwise Federal discounts association.

( step one ) The structure of one’s exchange required in making the fresh new tax credit or other income tax experts offered to the federal lender otherwise Government savings relationship;

( 2 ) The transaction was of minimal period and is not indefinite, together with sustaining a limited capital appeal that’s needed is legally discover proceeded taxation experts otherwise necessary to obtain the expected rate regarding go back;

( step three ) New tax benefits or other repayments gotten from the national bank otherwise Government coupons organization from the exchange pay-off the new money and you can supply the questioned price from return during the time of underwriting;

A national bank or Federal deals organization can get participate in income tax security finance purchases only if:

( 4 ) Consistent with paragraph (c)(3) with the section, this new national financial or Government offers relationship cannot have confidence in prefer of value in the project or assets liberties fundamental the fresh project for installment;

( 5 ) The brand new federal financial or Government coupons connection uses underwriting and borrowing from the bank recognition standards and you will standards that are dramatically equal to the underwriting and you will borrowing from the bank acceptance requirements and requirements useful a timeless commercial loan;

( six ) The brand new federal bank otherwise Federal discounts association is actually a passive trader on purchase which will be not able to direct the latest things regarding your panels business; and you may

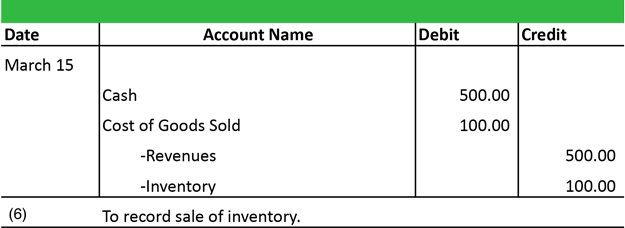

( eight ) The fresh national financial or Federal coupons organization appropriately makes up about new deal very first and on a continuing base and also recorded contemporaneously its bookkeeping research and you will completion.

( step 1 ) This new national financial or Federal discounts association cannot manage the fresh product sales of energy, or no, on the opportunity;

( 2 ) The brand new national lender otherwise Government discounts association limits the entire dollars level of tax guarantee funds purchases performed pursuant to that area to no more than four percent of the financing and you will excessive, unless of course the fresh OCC determines, by written recognition regarding a created demand because of the federal bank or Federal savings connection so you’re able to go beyond the five per cent restrict, you to definitely increased aggregate maximum cannot twist an unrealistic risk to the national financial or Government deals association and therefore the income tax guarantee money purchases from the federal bank’s or Federal coupons association’s portfolio may not be held in the a harmful or unsound manner; provided, although not, that for the no circumstances may a nationwide financial or Government discounts association’s complete buck amount of tax equity loans transactions done pursuant compared to that part exceed 15 percent of their funding and you can excessive;