Q: Will we mention qualities? Such as for example, there is certainly enormous stress in the Ca getting and funds a good family. Just how is SchoolsFirst working to make such financing occurs to suit your users, and how the majority of the company can it depict?

A: Folks are confronted because of the highest interest levels and better rates. Large interest levels are good for the users whom help save, in case you happen to be a borrower, it is difficult. You had been capable of getting a home loan to own 3%, nowadays they might be next to eight% and better. Which is a difference to your a house payment for the a premier-charged industry such as California.

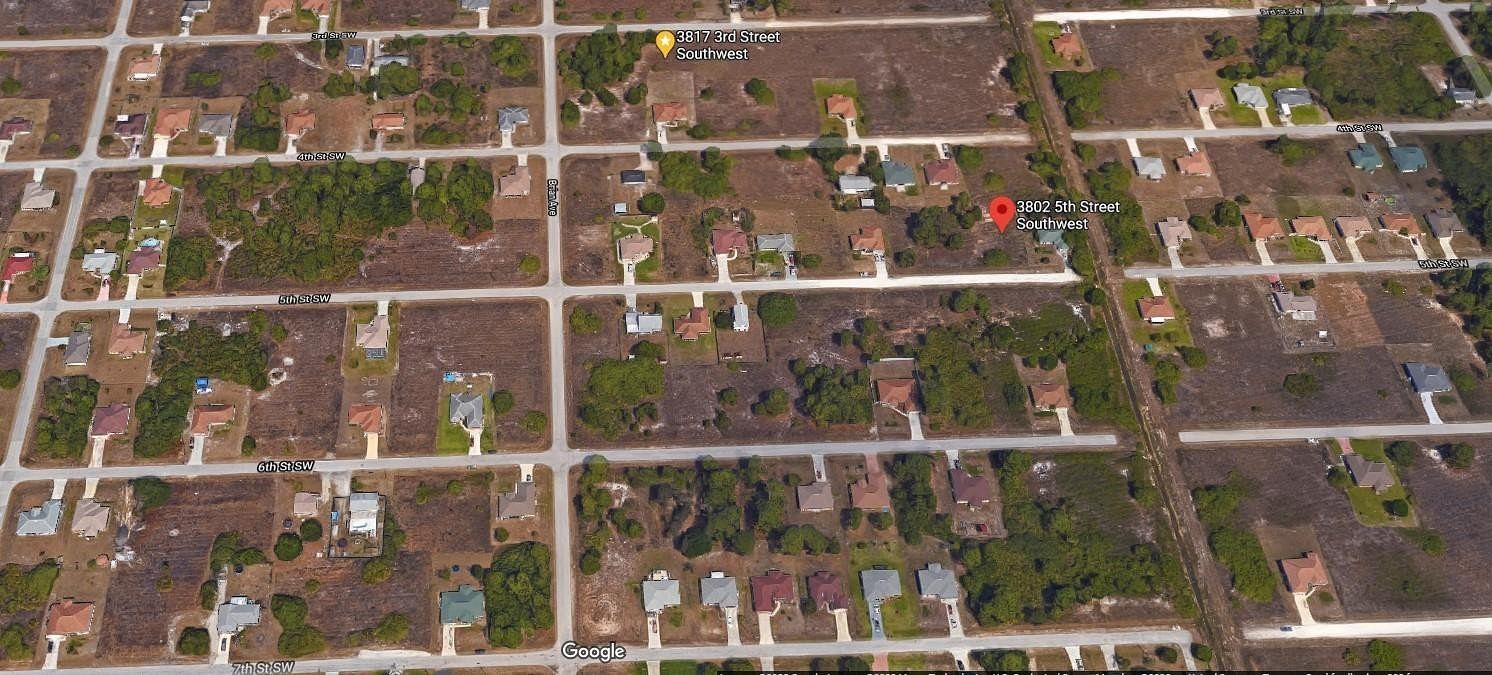

Home is a significant element of our team-lower than it was when cost was all the way down, however, i create create plenty of mortgage loans and you may domestic equity money. Much of all of our a property class is in Tustin, while we also provide process stores when you look at the Riverside and you will Sacramento, ca.

Which have first-mortgage credit, i have certain liberty, nevertheless prices are pretty much set by additional markets. Our very own cost was competitive, but the difference may possibly not be as much for the actual property top, because of your own means the business work.

By way of example, you will find a different school worker financial which have the lowest off commission with no private mortgage insurance requirements. Because of the perhaps not demanding them to have that, we can easily down their month-to-month cost somewhat considerably.

A: It can happens sporadically, nevertheless when we sell a loan, i maintain the servicing. The fresh representative nonetheless arrives owing to you getting that which you.

Organization: SchoolsFirst Government Borrowing Connection have more than 30 million from inside the assets and you will suits step one

A: We’ve got extended geographically, and we now have indeed changed much from the products that individuals bring along side ninety many years. I actually been toward 80th 12 months of the credit partnership, and this is, and we’ve seen many growth in the period several months. Yet ,, visite site while the our very own birth, we’ve existed worried about school staff and their family members with, as they say within purpose statement, world-class individual service.

A: Things are now changing quicker than before, and our very own member’s requires is actually altering. Cybersecurity is a huge price. I have a people right here one to protects our bodies and you will our very own servers. And you will, needless to say, you can’t unlock a papers otherwise stimulate an application instead of hearing in the AI.

In some areas, we have been using phony cleverness in our team for a long big date, nonetheless it is not necessarily the same as anyone. If the a member phone calls which have a question, instance, i have an internal pilot that makes use of AI to simply help the class quickly find the respond to because of the going through thousands of users out of important doing work methods. But one constantly responses this new member’s matter.

Continuous to focus on our members and you may greet their requirements and you will be cautious about their financial wellness-it is exactly what had me to this point. Which will be what is going to build all of us profitable in the future.

A: Yes. We’re broadening geographically in many ways. We provide an entirely-possessed subsidiary organization that provide 3rd-cluster administration features to help you more than 3 hundred university districts and you can condition offices. That’s broadening statewide since much north once the Las vegas County.

I together with work with a 3rd party to aid united states see in which our very own professionals try and you may where there is possibility of growth in terms of our future extension. I normally add 2 or three twigs a year, it is therefore not rapid increases; it’s regulated. Although individuals never enter a department, that they like to find out that there clearly was one to easier on it however, if they want they.

Costs Cheney

cuatro billion college personnel in addition to their families. It has got 69 branches and most three hundred ATMs statewide. Participants may also accessibility a collaborative out-of tens of thousands of free ATMs indeed there and you can all over the country.